Journal Entry For Borrowing From Bank On Note Payable

Content

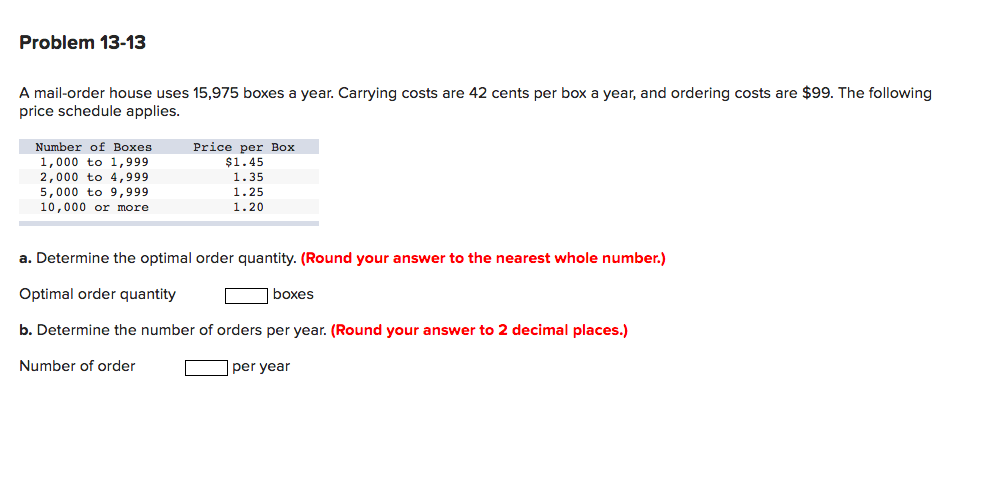

In our earlier example, the company would debit cash for $9,000, creditnotes payable for $10,000, and debit discount on notes payable for $1,000. The $1,000 discount is reported with the note on thebalance sheetto reduce its carrying price to the $9,000 amount borrowed. The notes payable is an agreement that is made in the form of the written notes with a stronger legal claim to assets than accounts payable. The company usually issue notes payable to meet short-term financing needs. In accounts payable, there is no need to issue promissory notes or to pay interest on the amount borrowed.

- This method of accounting, known as accrual basis, requires reporting all accrued liabilities so potential investors can assess the health of the company.

- Accounting for notes receivable can be burdensome and error-prone if approached manually.

- When sales taxes are not rung up separately on the cash register, total receipts are divided by 100% plus the sales tax percentage to determine sales.

- An interest-bearing note specifies the interest rate charged on the principal borrowed.

- At the end of each month, make an interest payable journal entry by debiting the monthly interest expense to the interest expense account in an adjusting entry in your records.

In the second case, the firm receives the same $5,000, but the note is written for $5,200. In Case 2, Notes Payable is credited for $5,200, the maturity value of the note, but S. The principal is just the total payment less the amount allocated to interest.

Learn The Basics Of Accounting For Free

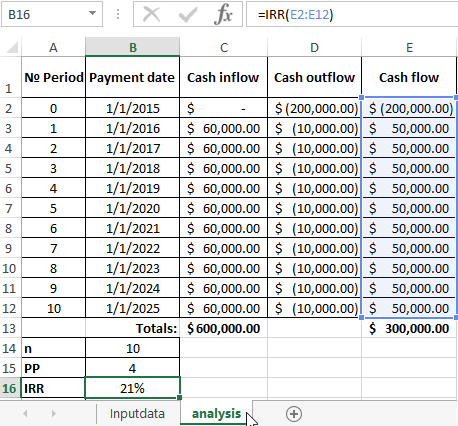

Note that since the 12% is an annual rate , it must be pro- rated for the number of months or days (60/360 days or 2/12 months) in the term of the loan. Short-Term Notes Payable decreases for the principal amount of the loan ($150,000). Interest Expense increases for $4,500 (calculated as $150,000 principal × 12% annual interest rate × [3/12 months]). The proper classification of a note payable is of interest from an analyst’s perspective, to see if notes are coming due in the near future; this could indicate an impending liquidity problem.

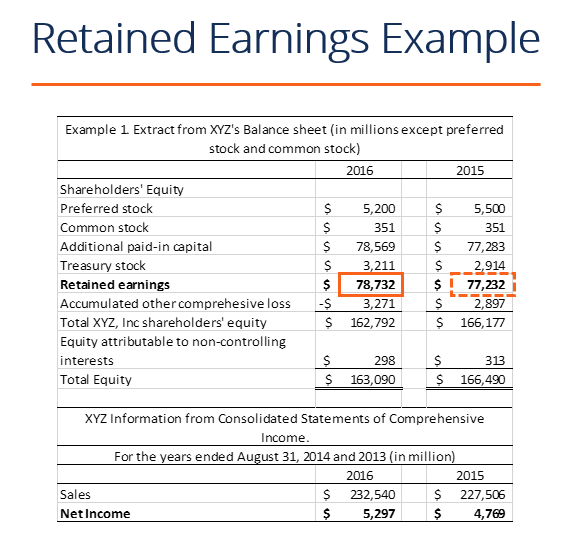

This interest expense is allocated over time, which allows for an increased gain from notes that are issued to creditors. In addition to these entries, the interest must be recorded with an additional $250 debit to the interest payable account and adjusting entry in cash. Notes payable always indicates a formal agreement between your company and a financial institution or other lender. The promissory note, which outlines the formal agreement, always states the amount of the loan, the repayment terms, the interest rate, and the date the note is due. Interest payable accounts are commonly seen in bond instruments because a company’s fiscal year end may not coincide with the payment dates. For example, XYZ Company issued 12% bonds on January 1, 2017 for $860,652 with a maturity value of $800,000. The yield is 10%, the bond matures on January 1, 2022, and interest is paid on January 1 of each year.

The revenue recognition principle and matching principle are both important aspects of accrual accounting, and both are relevant in the concept of accrued interest. The revenue recognition principle states that revenue should be recognized in the period in which it was earned, rather than when payment is received. The matching principle states that expenses should be recorded in the same accounting period as the related revenues. One problem with issuing notes payable is that it gives the company more debt than they can handle, and this typically leads to bankruptcy. Issuing too many notes payable will also harm the organization’s credit rating. Another problem with issuing a note payable is it increases the organization’s fixed expenses, and this leads to increased difficulty of planning for future expenditures.

Notes Receivable Defined: What It Is & Examples

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The present value technique can be used to determine that this implied interest rate is 12%. If the item is purchased outright for cash, its price would have been $15,000.

Amortization of the premium decreases the amount of interest expense reported each period. Amortization of the discount increasesthe amount of interest expense reported each period. The market interest rate is the rate investors demand for loaning funds to the corporation. The process of finding the present value is referred to as discounting the future amounts.

Notes Receivable Vs Accounts Receivable

The current portion of a long-term note payable is classified as a current liability on the balance sheet. The remaining balance of the note payable is classified as a long-term liability. No matter the reason the note was issued, interest is accrued under the terms of the contract and paid when due. Interest must be calculated using an estimate of the interest rate at which the company could have borrowed and the present value tables. The present value of the note on the day of signing represents the amount of cash received by the borrower. The total interest expense is the difference between the present value of the note and the maturity value of the note.

Sometimes corporations prepare bonds on one date but delay their issue until a later date. Any investors who purchase the bonds at par are required to pay the issuer accrued interest for the time lapsed. The company assumed the risk until its issue, not the investor, so that portion of the risk premium is priced into the instrument. Accurate and timely accrued interest accounting is important for lenders and for investors who are trying to predict the future liquidity, solvency, and profitability of a company. Accrued interest is usually counted as a current asset, for a lender, or a current liability, for a borrower, since it is expected to be received or paid within one year. F. Giant must pay the entire principal and, in the first case, the accrued interest. Interest expense is not debited because interest is a function of time.

The 860,653 value means that this is a premium bond and the premium will be amortized over its life. Both types of notes above involve two interest rates although often the two rates are the same on a given note. The stated rate is the rate stated in the note and determines the cash interest due on the note each period. The yield rate for the note is the rate on notes of similar risk and term. If the note is to be reported at present value, the yield rate is used for that computation.

Interest Payable Account

A company credits the interest payable account by the same amount recorded as interest expense. While a debit increases an expense account, a credit increases a liability. Using the previous example, you would credit the interest payable account by $2,000. This account’s new balance would also be $2,000 if its previous balance was zero. A note payable is classified in the balance sheet as a short-term liability if it is due within the next 12 months, or as a long-term liability if it is due at a later date. When a long-term note payable has a short-term component, the amount due within the next 12 months is separately stated as a short-term liability. Entries to the general ledger for accrued interest, not received interest, usually take the form of adjusting entries offset by a receivable or payable account.

- After this, the business must also consider the interest percentage on the loan.

- The principal of $10,999 due at the end of year 5 is classified as long term.

- When a promissory note is accepted, a business records the amount due on its accounting books as a note receivable, meaning an asset.

- In Case 2, Notes Payable is credited for $5,200, the maturity value of the note, but S.

Solvency ratios measure the ability of a company to survive over a long period of time. In recent years many companies have intentionally reduced their liquid assets because they cost too much to hold. It also helps to determine whether a company can obtain long-term financing in order to grow. Interest expense is reported in the “Operating activities” section, even though it resulted from debt transactions. The loss of $2,600 is the difference between the cash paid of $103,000 and the carrying value, $100,400.

Notes Payable Issued To Bank

Your day-to-day business expenses such as office supplies, utilities, goods to be used as inventory, and professional services such as legal and other consulting services are all considered accounts payable. Another approach, called the straight-line method, amortizes the discount or premium equally each period.

The difference between the exchange value and the face amount of the note signed is considered interest. Recording Interest on Notes Payable Determine the annual interest rate and the principal balance of a long-term note payable.

If the stated interest rate and the market interest rate are the same, the present value of the future cash flows is equal to the face amount of the note. If the https://accountingcoaching.online/ stated interest rate and the market rate of interest are not equal, the present value of the future cash flows is not equal to the face amount of the note.

Notes receivable are recorded as an asset account for the amount owed by the note “maker,” also known as the debtor. For the entity doing the lending, also known as a payee or creditor, notes receivable can improve cash flow.

This treatment ensures that the interest element is accounted for separately from the cost of the asset. If neither of these amounts can be determined, the note should be recorded at its present value, using an appropriate interest rate for that type of note. Disclose in notes to financial statements if the contingency is reasonably possible . Present value of remaining cash flows discounted at the effective rate. Installment notes, and when the yield and stated rates are materially different. List the two different methods of amortizing a discount or premium on a note. The loss is recorded by increasing a loss account and increasing a liability account.

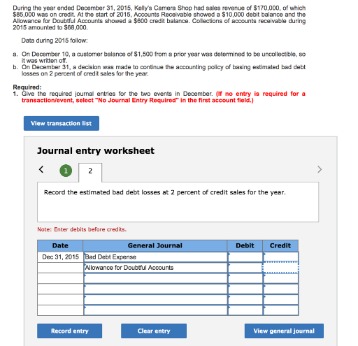

Adjusting Entries

As you repay the loan, you’ll record notes payable as a debit journal entry, while crediting the cash account. But you must also work out the interest percentage after making a payment, recording this figure in the interest expense and interest payable accounts. Noncurrent Interest-Bearing Note Payable — An interest-bearing note payable is one in which the interest element is explicitly stated. These notes are recorded at the present value of future cash flows, using the market rate of interest as the discount rate.

The size of the entry equals the accrued interest from the date of the loan until Dec. 31. Borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. The organization borrows money from the owner of the firm, and the borrower agrees to repay the amount borrowed plus interest at a specified date in the future.

Explain to someone who knows very little about accounting what a current liability is and illustrate by identifying major types of current liabilities. Notesdue for payment within one year of the balance sheet date are generally classified as current liabilities.

4 Prepare Journal Entries To Record Short

However, revenues distributed fluctuate due to changes in collection expectations, and schools may not be able to cover their expenditures in the current period. This leads to a dilemma—whether or not to issue more short-term notes to cover the deficit.

In Notes Receivable, we were the ones providing funds that we would receive at maturity. Now, we are going to borrow money that we must pay back later so we will have Notes Payable. Interest is still calculated as Principal x Interest x Frequency of the year . Revenue recognition is a generally accepted accounting principle that identifies the specific conditions in which revenue is recognized. An accrued expense is recognized on the books before it has been billed or paid. Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out. Accrued interest accumulates with the passage of time, and it is immaterial to a company’s operational productivity during a given period.

When the revenue is earned, the unearned revenue account is decreased and an earned revenue account is increased . Another is the withholding taxes—federal and state income and FICA, required by law to be withheld from employees’ gross pay. Most states require that the sales tax collected be rung up separately on the cash register. The seller collects the sales tax from the customer when the sale occurs and remits the tax collected to the state’s department of revenue periodically . Sales taxes payable – Sales taxes are expressed as a percentage of the sales price. To simplify the math, we will assume every month has 30 days and each year has 360 days. Full BioMichael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics.

To illustrate, let’s revisit Sierra Sports’ purchase of soccer equipment on August 1. Sierra Sports purchased $12,000 of soccer equipment from a supplier on credit. Let’s assume that Sierra Sports was unable to make the payment due within 30 days. On August 31, the supplier renegotiates terms with Sierra and converts the accounts payable into a written note, requiring full payment in two months, beginning September 1. Interest is now included as part of the payment terms at an annual rate of 10%. The conversion entry from an account payable to a Short-Term Note Payable in Sierra’s journal is shown.